PropNex Picks

|November 25,2025Upgrader 101: When, Why & How To Step Up From HDB To Private

Share this article:

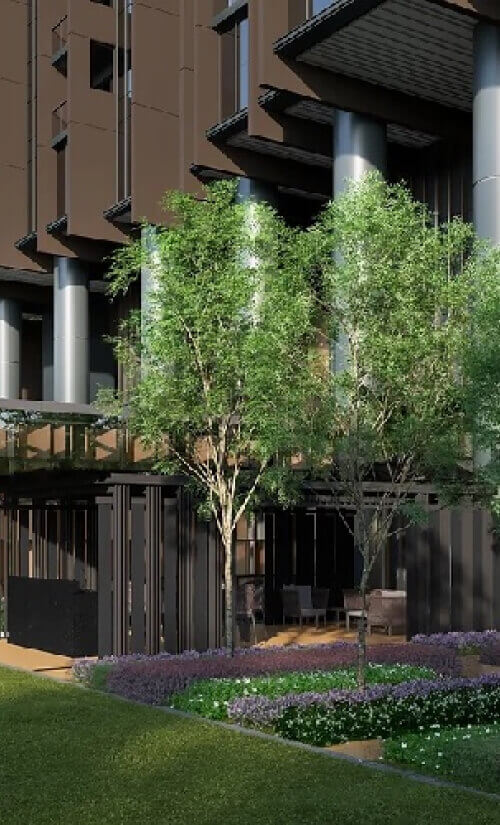

Singapore's housing journey is one of the world's most successful - with nearly 90% home ownership and over 80% of residents living in HDB flats. For decades, HDB has given Singaporeans a stable start - a first step toward independence, community, and growth.

Source: ABC News

But as property prices inch up and affordability tightens, many owners reaching MOP now face a big question: Should I upgrade? Some wonder if they can afford to. Others aren't sure where to start. And many are simply comfortable staying put in their "forever home." Yet, with prices rising faster than incomes, hesitation could mean being left behind.

This guide breaks down the key steps to upgrading confidently - from timing and financing to choosing the right property. Whether you're five years into your first home or planning ahead, it's time to understand how upgrading can move you closer to long-term financial freedom.

Upgrading isn't just a lifestyle move - it's part of a broader progression. Under the Property Wealth System (PWS), every home serves a purpose in your long-term plan: starting with stability, building clarity around your finances, then moving intentionally toward the next phase when you're ready. This structure-before-emotion approach ensures each upgrade supports your larger financial journey.

Upgrading isn't about showing off - it's about moving forward. Here's why many take the leap:

Lifestyle & space: Access to more privacy, better facilities, and room for a growing family.

Financial Growth: Build equity, diversify wealth, and unlock potential capital gains.

Future-proofing: Use property as a long-term asset that grows with you.

SAUE principle: Save As You Earn - a disciplined approach that encourages homeowners to Save - Accumulate - Upgrade - Enjoy, turning savings into a roadmap for financial progression.

For some, upgrading marks a new chapter in family life; for others, it's a strategic step in wealth building. Either way, it's about aligning your home with your future - not just your present.

Upgrading also means thinking ahead about policy rules and long-term asset value - not just market timing. Plus/Prime flats, for instance, come with tighter resale buyer eligibility and subsidy recovery, which can affect your pool of future buyers. Likewise, older HDB flats face lease decay, which may impact valuation and loan restrictions over time.

In the private market, supply in the OCR has been tightening, driving stronger competition for well-located projects - a factor that may influence both entry price and future resale demand.

Timing an upgrade isn't about luck - it's about readiness.

1. Personal readiness

Have stable income, manageable debt, and an emergency fund? You're halfway there. Think about life plans - kids, job shifts, retirement - that may affect affordability. Our PropNex agents, powered by award-winning technology, can help you assess your finances and upgrade potential with data-driven clarity.

2. Market conditions

Interest rates are still expected to ease into 2026, though more gradually than before. The resale and OCR segments are seeing healthy momentum, offering opportunities for strategic buyers. Don't rush - but don't wait until prices outpace your income.

3. HDB status

You can only sell after meeting your MOP (5 years for standard BTOs, 10 years for Plus and Prime BTOs). Evaluate your flat's current resale value, demand in your area, and whether any grants need to be refunded. Assessing this early helps you plan your timeline strategically to avoid rushed decisions.

Smart upgraders assess all three before committing. The goal isn't to chase timing - it's to anticipate changes, prepare early, and act confidently when the conditions align.

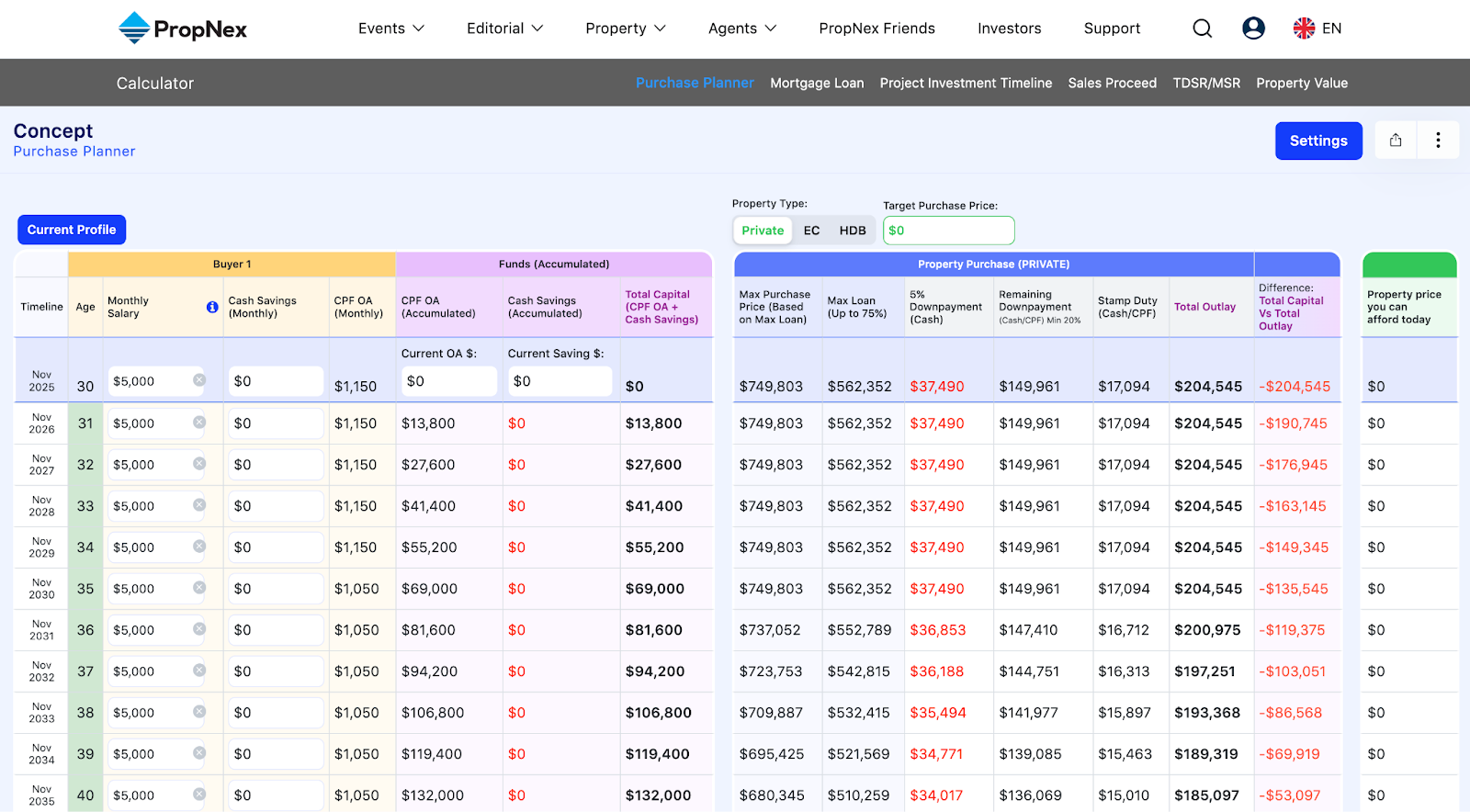

A key part of upgrading is understanding how financing rules shape what you can and should afford. Beyond upfront costs, you'll need to navigate concepts like the Total Debt Servicing Ratio (TDSR) - which caps how much of your income can go toward monthly debt. This affects your loan size, especially if you still have an existing HDB loan or other financial commitments.

Upgrading looks exciting - but it comes with commitments. Here's what to plan for:

Downpayment: 25% of the property price (minimum 5% cash for bank loans)

Stamp duties: Buyer's Stamp Duty applies; ABSD may apply if you buy before selling your HDB

Bridging loan: Short-term financing to cover gaps when selling and buying concurrently

CPF refund: When selling your flat, your CPF used (plus accrued interest) must be refunded before using it again

Other costs: Renovation, monthly maintenance, property tax, and insurance

Quick comparison example:

Cost Item | HDB (4-room) | Condo (2-bed) |

Loan repayment | ~$1,600/month | ~$3,200/month |

Maintenance fees | <$100/month | ~$300/month |

Utilities | ~$150 | ~$200 |

Upgrading may look exciting on paper, but the reality of upgrading often reveals hidden costs, loan complexities, and long-term commitments that require careful financial planning - and that's where proper guidance becomes essential. Fortunately, we have property calculators to help you calculate affordability instantly, ensuring you plan with clarity.

There's no one-size-fits-all route - each comes with trade-offs. To help you compare them more effectively, here are clearer, more specific details:

1. Sell first, then buy

Pros: No ABSD, clearer financial picture, and more time to evaluate your next purchase carefully.

Cons: Need temporary accommodation or to rent in between, which may add short-term costs.

Typical timeline: Once your HDB Buyer's OTP is exercised, you usually have 8-12 weeks before completion - enough time to shortlist and commit to your next home without rushing.

2. Buy first, then sell

Pros: Seamless transition with no need to rent; ideal if you've already identified your next home.

Cons: Requires higher cash flow, upfront ABSD (refundable later), and strong financial planning to manage both loans temporarily.

ABSD refund specifics: You must sell your HDB within 6 months of buying the private property to qualify for the refund (Singaporean married couples only).

Pros: Potential to generate passive income from HDB rental while building wealth through a second property.

Cons: Heavier financial load and ABSD applies.

Rental rules: To rent out your whole HDB unit, you must obtain HDB approval, meet the MOP requirement, and comply with minimum/maximum rental periods and tenant eligibility.

Case in point:

Lena and her husband chose to sell first. Their HDB was sold within 3 weeks, giving them a clear profit breakdown and a stronger cash position. With a confirmed timeline and no ABSD pressure, they secured a 3-bed resale condo in the OCR comfortably within the 12-week window.

Whatever your route, plan early. Our agents can help stimulate timelines, compare costs, and ensure your upgrade aligns with both your financial comfort and long-term goals.

There's no one-size-fits-all route - each comes with trade-offs.

Your first private property should fit your lifestyle and financial plan. Beyond the excitement of owning a condo, remember that not all projects offer the same long-term value. Here's how to evaluate carefully before committing:

Location: Proximity to MRT, schools, and future developments remains a key driver of value. Look for areas with planned transport links or government rejuvenation projects.

Property type: Decide between new launch and resale - new for modern facilities and potential appreciation, resale for larger layouts and immediate availability.

Size vs Lifestyle: You might need to compromise on size for location or amenities, but ensure it still meets your daily comfort and family needs.

Growth potential: Research undervalued areas or upcoming transformation zones. A property's surroundings - from new malls to business hubs - can significantly influence capital gains over time.

The reality of upgrading is that it's not just about choosing a beautiful home - it's about balancing lifestyle desires with strategic financial foresight. PropNex's extensive project portfolio and data-driven insights can help you evaluate options objectively and match you to the right property with confidence.

Upgrading isn't about chasing a lifestyle ideal - it's about making a clear, well-structured decision that supports your long-term goals. In line with PWS, every move should be intentional: understanding your numbers, evaluating your options, and ensuring your next step strengthens your financial position.

When approached with clarity rather than emotion, upgrading becomes more than a change of address - it becomes a step up in resilience, flexibility, and future readiness. A well-chosen property can offer liquidity, optionality, and room for restructuring as your needs evolve.

Instead of focusing on features or trends, anchor your decision in a simple question: Does this upgrade bring me closer to long-term stability and progression?

Our advisors can help you think through these considerations with structured, data-backed guidance - so you stay focused on strategy, not guesswork.

The strongest property moves aren't rushed. They're clear, calculated, and aligned with your future.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.